Polkadot is one of the many new platforms out there that provides an incentive for computers to facilitate and operate a blockchain. Users can use Polkadot to release and operate their blockchains as well.

This type of technology sets to grow the ecosystem of cryptocurrencies like many other similar platforms like Ethereum and Cosmos.

Having been released in 2020, Polkadot offers new innovative advantages over some of its competitors.

What is the DOT?

Like many other blockchains that have their novel tokens, the novel token for the Polkadot infrastructure is DOT.

The main responsibilities for the DOT token are participation in governance decisions and to be used as an electronic payment system. Polkadot has a unique multilayer governance model that allows for updates to any protocols without the need for conducting hard forks. Hard forks are known to cause volatility and instability for a cryptocurrency. Merchants can also accept DOT tokens as a payment method that can be easily integrated using platforms such as NOWPayments.

What are the advantages of Polkadot?

The main advantages of Polkadot compared to other similar platforms is: interoperability and security. Polkadot’s relay-chain infrastructure allows users to connect individual blockchains to one another. This means that data from one blockchain can be transferred to another. This has endless benefits in the realms of scalability. This possibility reinforces the security of developing on Polkadot. Developers could develop and operate their technologies on a private blockchain and then use it on a public blockchain.

These capabilities along with Polkadot’s robust and vibrant ecosystem have some analysts envisioning Polkadot being a real threat to Ethereum’s current dominance.

How to Buy a Polkadot (DOT) on Binance?

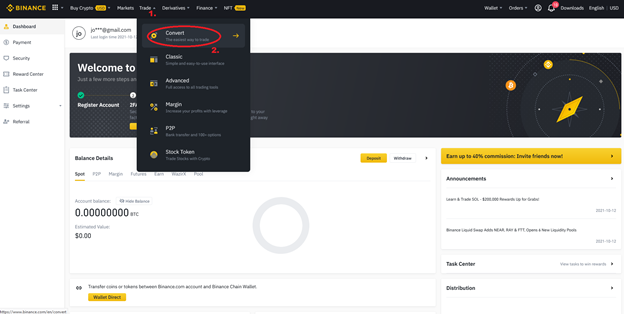

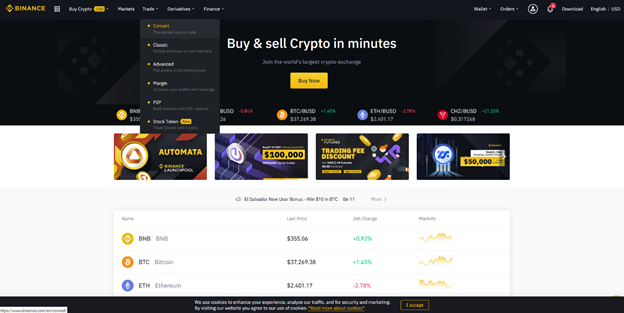

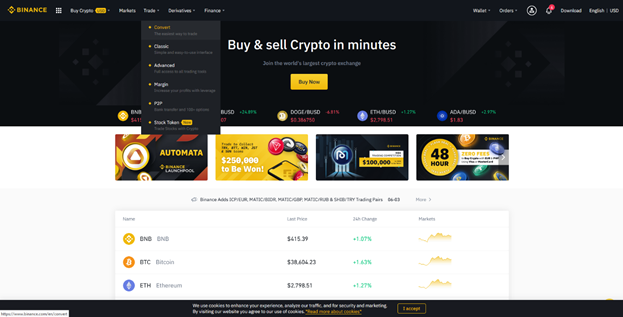

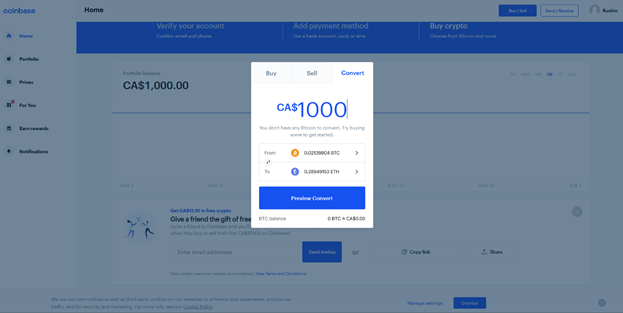

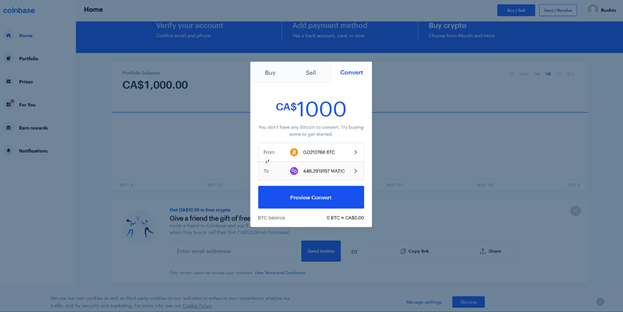

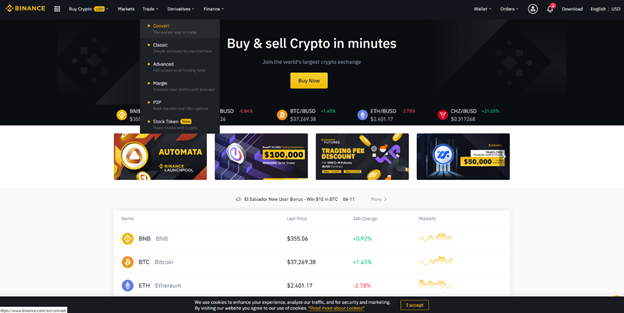

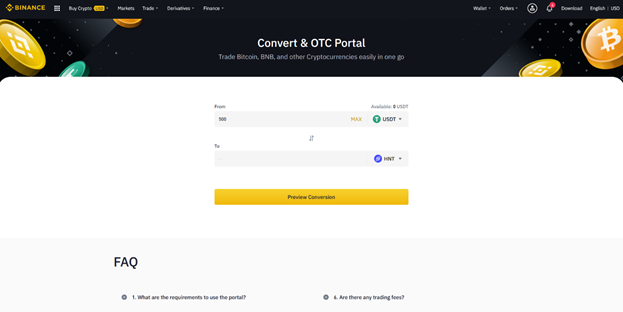

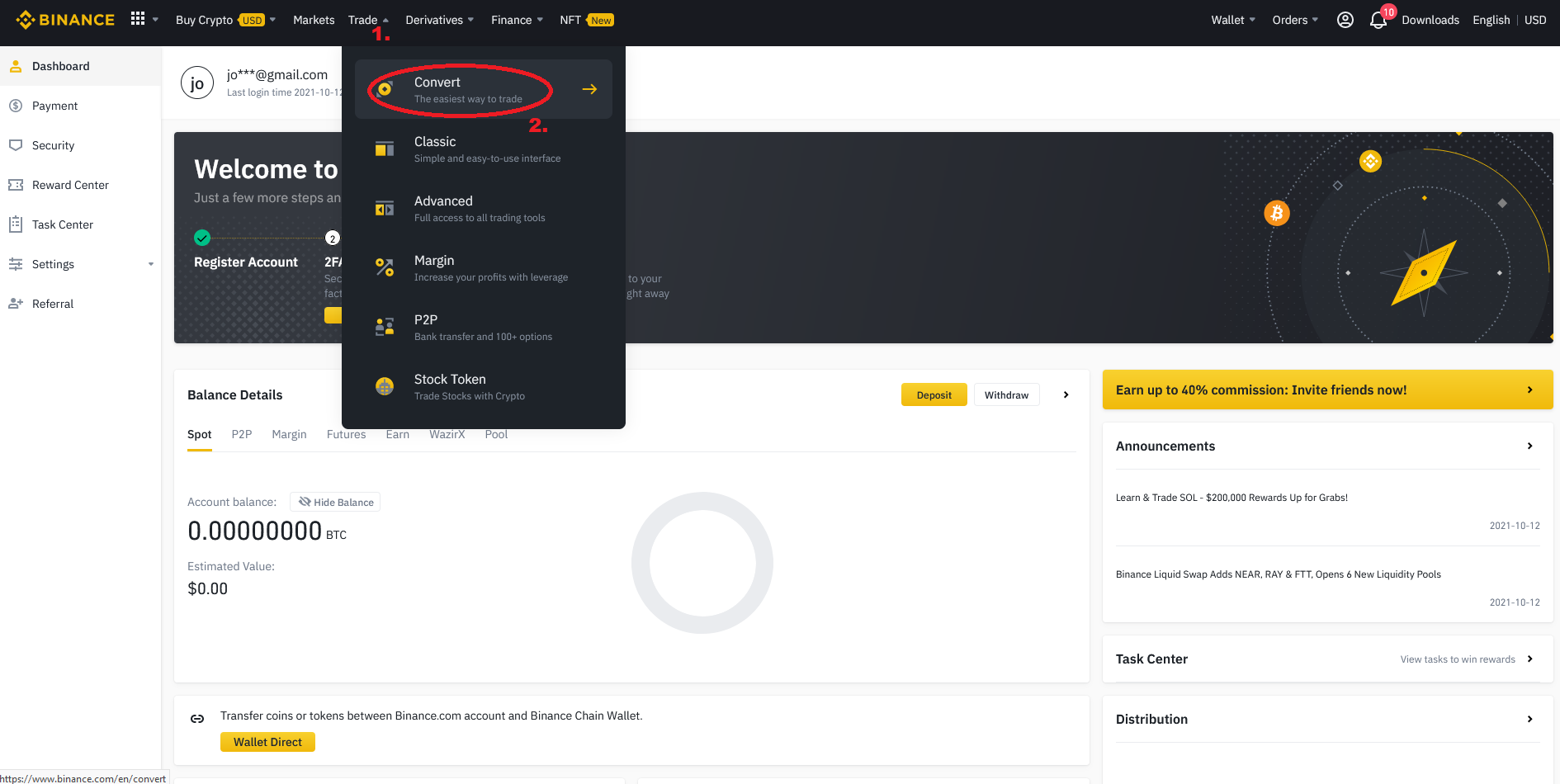

Login to your Binance account, once you are there, click “Trade” and then click “Convert”.

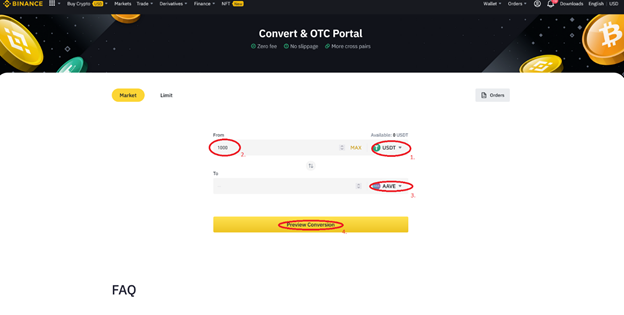

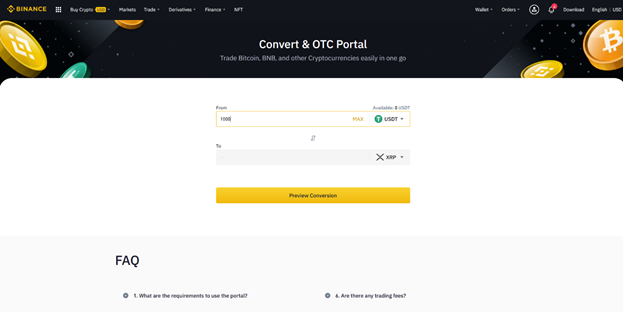

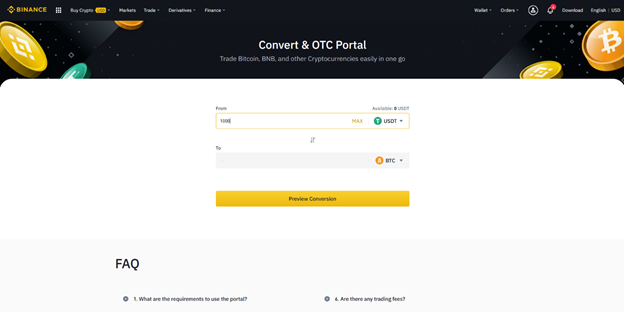

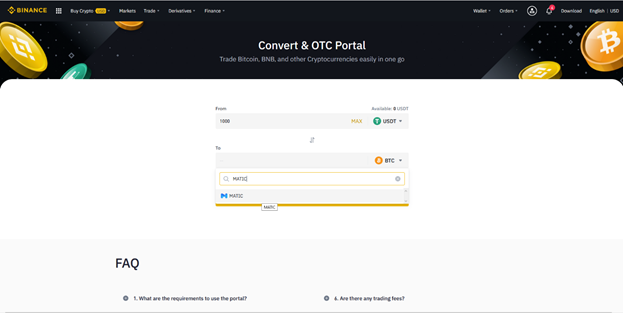

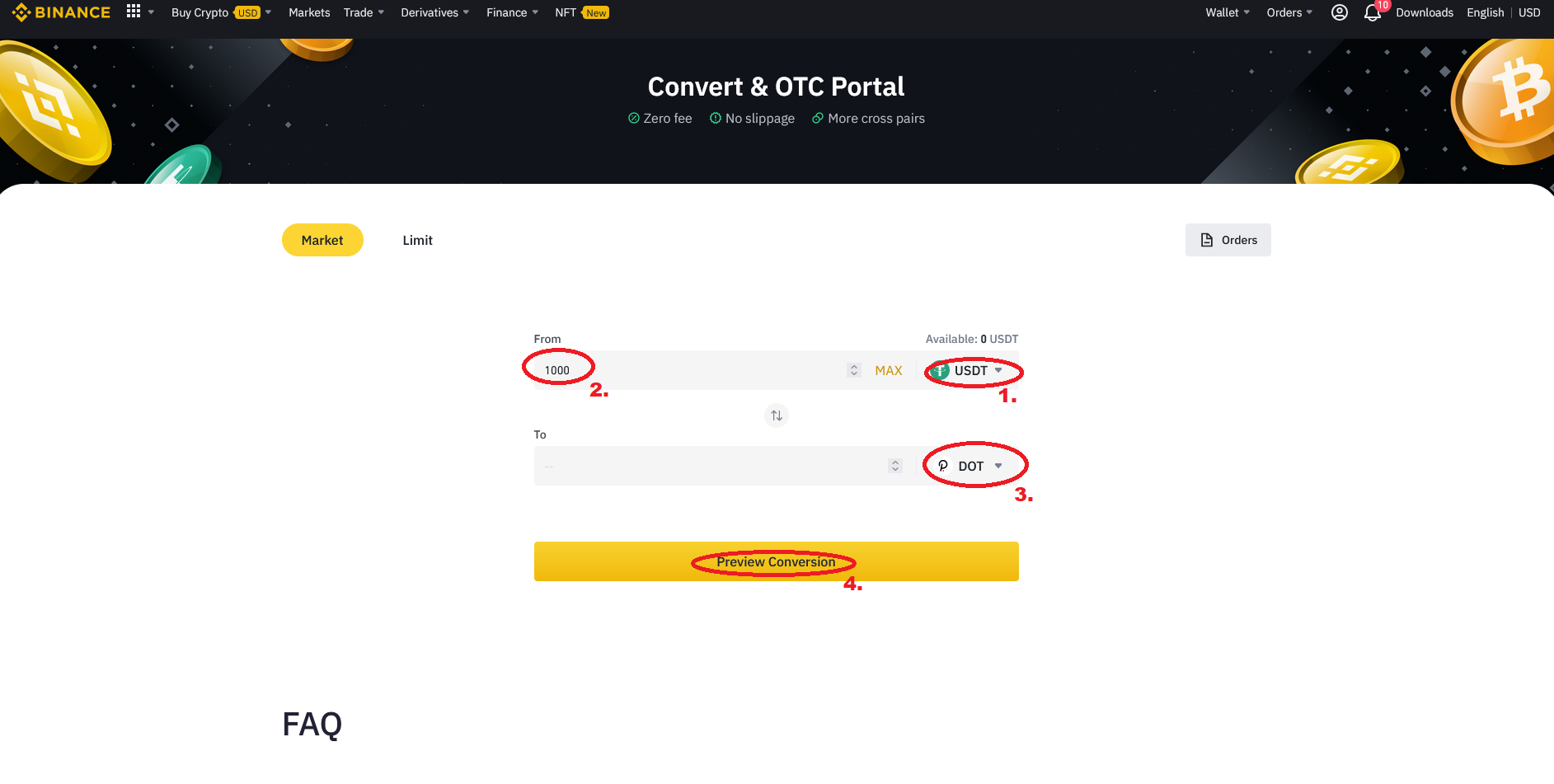

In the “From” section, choose which cryptocurrency you’d like to convert and specify how much. Then in the “To” section, select “DOT” from the dropdown menu. Then click “Preview Conversion”.

On the next page, review the details of conversion before hitting “Convert”.

Future Outlook for Polkadot (DOT)

Touted to be a possible competitor for Ethereum’s blockchain dominance, Polkadot’s future seems bright as more and more importance is put on scalability and security.

Currently, Polkadot is trading near $34.50 after opening at $50.67 to the public back in August of last year. In the short term, Polkadot is forecasted to hit $68 as more and more investors recognize it as the fastest transacting cryptocurrency.

Price could extend considerably higher in the next five years as this unique infrastructure inquires collaborations from crypto exchanges and prominent blockchain networks like LINKS. Some forecasters have the price reaching as high as $526 by the end of 2026. Granted how popular Ethereum is despite its notable drawbacks, investors and developers may opt to use Polkadot as its novel advantages become harder and harder to ignore.